I am keeping my powder dry either until 5/24 or until a break of moving average support as discussed below. I will keep the minimum 2.5% longer-term short in keeping with the I1 rules.

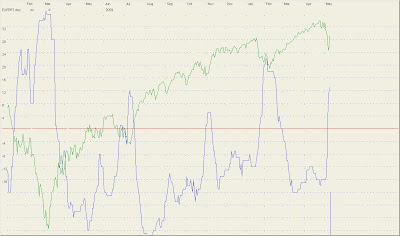

I1 sell signal in effect for long-term traders destined for 6/8 bottom. However, I1 bottomed today and will levitate until 5/24. Here is the current I1 chart:

The daily technical composite moved up to +13 as a result of the decline. This is a minor buy signal:

The market has still not broken critical resistance and as long as the DJI stays under 10,860 the bear is alive. The confirmation of the bear is below this afternoon's lows in the cash market (break of the 320-minute M/A):

Here is the futures' breaking point. This M/A will be moving up through the night and will be above 1145 by the opening tomorrow:

The rally off of Thursday's low does not count 5, so the structure of this rally does not support higher prices.

Europe is throwing 763 billion euros at the wall. Some of it will stick, most of it will not. The funds will be used for extending loans (EU and IMF) both public and private. ECB has already started buying government and private bonds.

This is in addition to the 110 billion euro for buying greek bonds and extending loans to the Greek government, which is risky even in good economic times. The Greek reality is different than that of the Germans. To the Greeks a loan is only an inconvenience, a pause in the rush to spend. An inconvenience is not a committment and when push comes to shove the speed of default will be like a Zeus thunderbolt. And shove is coming fast.

Short-term the contagion is defeated. The problem is the concept of money. Even the Germans perceive money differently than their grandparents. To them the loans keep the EU afloat and their trade alive. To their grandparents money represented the only thing between themselves and starvation (and their childrens' starvation).

The only loans and bonds that will survive are those private loans and bonds that survive a great depression. However, how many countries and companies that come for the money will be survivors? Very few, if any.

So, contagion contained for a year. Is euro contagion the only reason to sell the markets? No. In addition, every euro squandered will come back to haunt Europe in the markets in the not-too-distant future. America is all in, now Europe is all in. No more funds will be forthcoming from treasuries or central banks for bad debtors.

Hi Steve,

ReplyDeleteMy timing model which bottomed on Sunday 9 May is set for the next bottom on 8 June...a date you may recognize, the one after that is in early July. The rules I developed for it say to buy on close of day when signal bottoms and stay in for 5 trading days. This was how it was optimized but sometimes 4 sometimes 6 etc works best. It is purely a timing model, price plays no role. When it falls on a weekend like the 9th, the backtest showed it best to buy late rather than early hence Monday not Friday, which wasn't the best in this case obviously with the European intervention. I optimized it around the rules for my 401k so obviously one could have bought the early futures on Sunday around 1126-1130. So, I did buy in but not with conviction. Thus, I plan to be long gone before the 24th top on I1 and retreat to the safety on the G fund.I saw a comparison to the mid 2007 action with 4 90% down distribution days that was followed by a retest of the high before the collapse began. I am beginning to think we may see that here (not a retest of the 2007 highs, but the recent ones). Some Dow theorists will see a retest of the highs that fails to make new highs as a sell signal based upon a full 10% correction that we saw. I saw a prescient article about the european bailout: the premise was that right now all they have is a plan with no way to implement or pay for it, so it may not last as more than a smoke screen for a month or so.

Cheers!

Steve,

ReplyDeleteYou've backtested I1 to 1966. Can it be backtested farther to 1896 and the start of the Dow? Or do some of the data series not exist? If possible, I would be glad to help with that project.

Charles

Hi Charles,

ReplyDeleteThe data just does not exist prior. What does exist would build an incomplete model. In addition, I1 is constructed in a multi-phase process using correlations from different market segments (represented by DJI, SPX, and Nasdaq Composite). Nasdaq was formed in 1971 but the data starts in 1970. So already the pre-1970 series lacks the multiple segments that I believe are critical to it's success.

Maybe we can work on another project...

Your timing model does not use price. Interesting...what is it's basis?

ReplyDelete