Not a bad day, up a few bucks. Came in 2% SSO from 38.17 and 1% DJ futures from 10,609. Bought 2% SSO at 37.80 and sold that at 37.76. Bought 1% DJ futures at 10,516. Sold 2% futures at 10,555. Bought 2% DJ futures on stop 10,573 which was hit after FOMC. Currently long 2% DJ futures and 2% SSO.

We are in the 5th Sub-Micro of the 3rd Micro wave of Sub-minuette c of the final abc of the diagonal triangle and it should seek new highs before done.

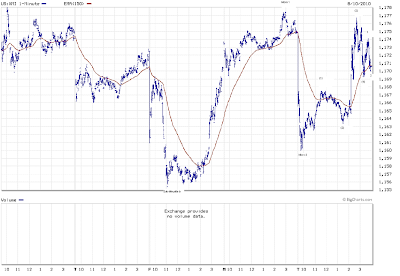

Here is my current count:

And again at today's Micro level:

There is still plenty to go wrong with this count, but the way it plays out that Micro5 completes the diagonal at or above the trendline on Friday.

Steve,

ReplyDeleteAre you holding a short position at this time? or are you waiting until Friday to enter short?

I am long.

ReplyDeleteHi Steve,

ReplyDeleteI believe your count works as long as you are treating the entire move up from the July 1 low as wave C. So the bigger picture for that count is that that wave C is the last wave of an expanded flat.

An alternate count has the July 1 low as the end of primary wave 1 (which played out as a Leading Diagonal). This count has the move up from that July 1 low as an ABC zigzag where the C of the zigzag began at the July 20 low.

Here is a screen shot of this alternate count:

http://screencast.com/t/ODQ2NjVjOD

The only problem with this count is that it doesn't line up with your I1 timing because this count has us in wave 3 of C and it's not likely to complete that wave AND waves 4 AND 5 by Friday.

pima

ReplyDeleteThanks for getting back. I1 has a knack of narrowing things down. I keep expecting a burst of optimism to barrel the market through 10,700. Once it occurs it's good for over 100 DJI points. Throwover probability is being reduced as it toils below there.