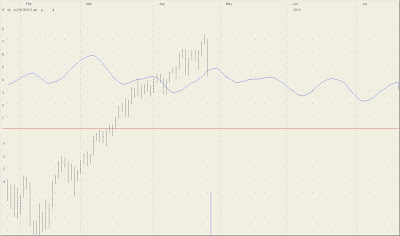

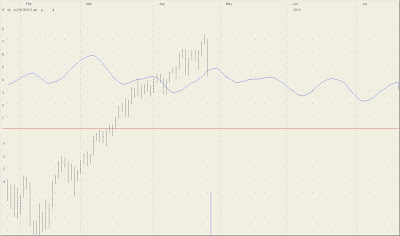

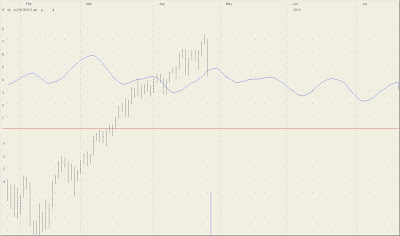

OK, the stock market on Tuesday broke critical support in the cash and futures markets. It did catch bids at the low Friday 4/16. Yesterday at 10,974 and today at 10,965. My short entry on weakness was at 10,957 so I just waited for a rally to take prices up. I took a small position when SPX hit it's 15-minute, 54-unit M/A and I don't particularly want to be short stock with 1 day left in I1. Small position. I am also long bonds in a tiny position (relative to beta). I expect stock market to rally and then hold up into late afternoon tomorrow at which point I will substantially increase exposure. If this is the case then I will show minor losses in my leg-in positions but I have a place at the table if Europe implodes (small price to pay, eh?). The following charts can be used as reference for the above narrative:

The important points are:

1) The top is in

2) Critical support was broken

3) I1 tops tomorrow and is then a formal sell (trough < 3.25) with initial trough date 5/10-5/11 at which I will get out of half of the shorts.

Here is the I1 as of yesterday's close:

No comments:

Post a Comment