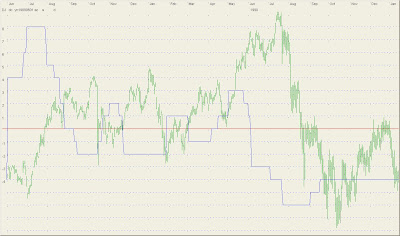

Observation of I1 and it's components has uncovered a subtle forecasting tool. The I1 and some of it's components that presage market moves by spending extended periods at elevated and depressed levels.

The following charts show periods of market activity that illustrate the new indicator's behavior. The rule set is as follows:

1) Buy signal. Buy at +2 if a move subsequently extends to +5. Exit on return to +4.

2) Sell signal. Sell at -2 if a move subsequently extends to -5. Exit on return back to -4.

1) Buy signal: Buy -3.5 if the move subsequently extends to +5. Exit on return to +5.

2) Sell signal: Sell +4 if the move subsequently extends to -3. If trough >-5 then exit on trough and -2.

If trough >-10 then exit on trough and -3.5. If trough is below -10 then exit on -10 and -2.