IF the SEC case is shown to be a good one then the derivatives game winds down to a lower level. Goldman Sachs ran a trillion dollar derivatives game, creating and brokering product around the world. The example in this case is not the worst offense, by far, but is the only one that the government can prove with a smoking gun e-mail.

GS paid and guided the grading companies as to the investment risk associated with products that it packaged. GS knew the actual risk composition of the product and also knew that it varied widely from the rating assigned. GS marketed these products with fictitious ratings while keeping mum on the shoddy tranches within the products. GS made tens of billions in the decade that it made book on mortgage derivatives. GS was not the only deceitful packager, almost all of the major banks played the same game and are the second shoe to drop. Which is why the market declined today.

The SEC does not have a good track record of proving fraud. It cannot hire minds of near the caliber of GS. Back to the point: IF the SEC case is shown to have merit the volume and notional value of derivatives will decline by at least half over several years. Regulation of derivatives will dimish the potential profitability of new product and existing product of questionable quality will self-liquidate. The money supply, based as it is on debt outstanding, will contract as the level of derivatives unwinds. Just as the creation of derivatives stoked world economic expansion until 2007 it will serve as a brake on the world economy going forward. Commodities are a short-sale now as the new reality sets in.

Stocks were down but did not break critical support at 10,930. Until this happens I will sit on my hands. It is hard to break bullish psychology, even when a seminal event occurs such as today. I expect a sigh-of-relief rally to carry stocks back to near the highs. The high tick has probably already occurred, with topping action likely over the next week or two. I still hope for I1 to levitate the market, even though I suspect that will not occur; that within the next week the DJI will break support.

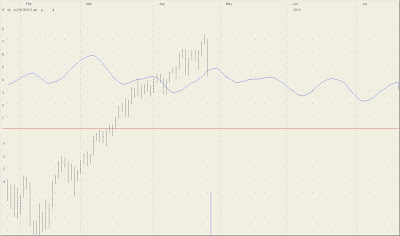

Posting the I1 chart:

There is a formal sell signal at the 4/29 peak because the trough June 8 is below 3.25 (actually 2.53). There is an intervening bottom 5/10 at 3.61 that peaks 5/24 at 4.01. Since this is less than a .50 move I am ignoring it for longer-term trades.

As I promised last week I will be posting the slow version of I1, which isolates longer trends:

Use of the slow I1 is:

1) Timing of tops and bottoms is precise only for major moves (15% in 3 months). Minor turns are always late due to the moving average

2) Short-term tops and bottoms (moves less than 15% in 3 months) should use the normal I1 for pinpoint turn dates.

So, if the market is in a fast move use of the slow I1 is beneficial.

Silver was down a ton. I bought ZSL at 38.40 when the 90-minute close on May futures declined below 18.15 (well below, which is why the fill does not provide me with the profit that the chart may indicate. ZSL closed at 39.20.

Bought small and will wait for a rally to 18.00 in the may futures to add to position.