Tuesday, August 31, 2010

8/31 9:10pm

Stopped out of short DJ futures at 10,035. Rally from 4th wave rectangle confirms 5 up in futures markets.

8/31 Daily Commentary

SPX 1040 is tough support. My favorite scenario is a false break which will mark the I1 low. My tactics are to maintain position until the I1 turn date on Thursday. I've reduced exposure to 2% DJ futures with a stop at 10052 and 6% QID.

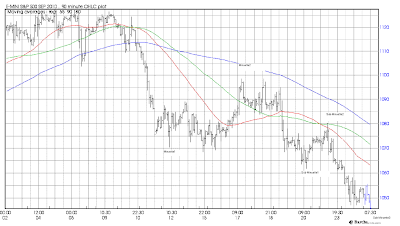

There is a M/A cluster on the SPX 15-minute chart:

Also, SP futures hit the 30-minute M/A at 1053.

DJ futures have been restrained on the upside by a moving average all day after hitting the 50% retracement from Friday's high early in the session. The down-sloping blue M/A has a tight envelope of 10,545 but I'll put my stop at 10,552.

I've been struck recently by how mystified economists and laypeople are concerning the inability of the economy to add jobs. When I was in college I took jobs during holidays and summers in a manufacturing plant making parts for engines and a phosphate rustproofing company treating nuts, bolts, and small bulky parts. Those companies are long gone without replacement. We transitioned from making things to concept products. I worked in the software biz all during the great productivity binge of the 70s, 80s, and 90s brought about by computerization of processes. The process side decreased as the financial software side increased. By the end of the 90s the US had what was left of it's manufacturing highly computerized and productivity gains were nominal. By not making physical goods, in particular capital goods, we have doomed a large portion of our workforce to obscurity. The human population functions within a bell curve of intelligence. In particular the ability to conceptualize sytems and processes and to devise mathematical models to represent them is key to remaining employed in a conceptual economy. In the software industry there is little demand for employees on the lower 75% of the bell curve. Two men in a software distribution center can get product out for 100 developers. Secretaries, same thing. This is opposite the case when physical things are manufactured because they require machinery set-up, monitoring, and operation. Even with robotics and computers there is a need for many plant floor employees to change the programming over for different processes as well as environmental monitoring and control, parts inventory, quality control, machinery maintenance, and much more. These jobs are now in China where they will remain. The educational system in the US has gone the other way with teachers and educational systems short-changing mathematics and sciences in the process of turning out mediocrity and collecting federal monies. The students being produced today are hopelessly unprepared for technical fields. Our solution now is to grant as many green cards as we can to foreign workers to make up the gap as boomers retire.

Wake up, America. China has categorically rejected Microsoft products on their desktops and laptops in favor of freeware. There are very few niches that superior knowledge can garner in the world. That superior knowledge is shrinking all the time because the world will steal knowledge and knowledge products without thinking about it. The countries with the least debt overhang will continue to gain in manufacturing and the rest of the world will just limp along. Low debt in the long run means lower costs and greater policy flexibility both corporate and governmental. America is high debt but temporarily enjoys low interest rates. This gives us the illusion of control but assures long run economic flatline. The developing world will continue to use vastly more resources as they industrialize and consumerize. The only silver lining is that the high debt countries will import less and thus restrict developing countries' growth. The depression will forestall the visiblity of the effects of our demise due to a continuation of low interest rates and struggling developing economies coping with reduced exports to the developed world. As long as our politicians can keep the truth obscured they will continue with mad policies and delay the day when our political system is turned upside down.

There is a M/A cluster on the SPX 15-minute chart:

Also, SP futures hit the 30-minute M/A at 1053.

DJ futures have been restrained on the upside by a moving average all day after hitting the 50% retracement from Friday's high early in the session. The down-sloping blue M/A has a tight envelope of 10,545 but I'll put my stop at 10,552.

I've been struck recently by how mystified economists and laypeople are concerning the inability of the economy to add jobs. When I was in college I took jobs during holidays and summers in a manufacturing plant making parts for engines and a phosphate rustproofing company treating nuts, bolts, and small bulky parts. Those companies are long gone without replacement. We transitioned from making things to concept products. I worked in the software biz all during the great productivity binge of the 70s, 80s, and 90s brought about by computerization of processes. The process side decreased as the financial software side increased. By the end of the 90s the US had what was left of it's manufacturing highly computerized and productivity gains were nominal. By not making physical goods, in particular capital goods, we have doomed a large portion of our workforce to obscurity. The human population functions within a bell curve of intelligence. In particular the ability to conceptualize sytems and processes and to devise mathematical models to represent them is key to remaining employed in a conceptual economy. In the software industry there is little demand for employees on the lower 75% of the bell curve. Two men in a software distribution center can get product out for 100 developers. Secretaries, same thing. This is opposite the case when physical things are manufactured because they require machinery set-up, monitoring, and operation. Even with robotics and computers there is a need for many plant floor employees to change the programming over for different processes as well as environmental monitoring and control, parts inventory, quality control, machinery maintenance, and much more. These jobs are now in China where they will remain. The educational system in the US has gone the other way with teachers and educational systems short-changing mathematics and sciences in the process of turning out mediocrity and collecting federal monies. The students being produced today are hopelessly unprepared for technical fields. Our solution now is to grant as many green cards as we can to foreign workers to make up the gap as boomers retire.

Wake up, America. China has categorically rejected Microsoft products on their desktops and laptops in favor of freeware. There are very few niches that superior knowledge can garner in the world. That superior knowledge is shrinking all the time because the world will steal knowledge and knowledge products without thinking about it. The countries with the least debt overhang will continue to gain in manufacturing and the rest of the world will just limp along. Low debt in the long run means lower costs and greater policy flexibility both corporate and governmental. America is high debt but temporarily enjoys low interest rates. This gives us the illusion of control but assures long run economic flatline. The developing world will continue to use vastly more resources as they industrialize and consumerize. The only silver lining is that the high debt countries will import less and thus restrict developing countries' growth. The depression will forestall the visiblity of the effects of our demise due to a continuation of low interest rates and struggling developing economies coping with reduced exports to the developed world. As long as our politicians can keep the truth obscured they will continue with mad policies and delay the day when our political system is turned upside down.

8/31 2:45

The minutes from FOMC underscore the degree of divisiveness within the Fed. Not everybody is a lapdog that follows Uncle Ben. The market cannot count on anything other than token responses to the next leg down in the economy.

Got short again DJ futures 9988 2%.

Got short again DJ futures 9988 2%.

8/31 2:30

Covered DJ short at 9995. I am awaiting NQ to decline below 1765.50 to go short again. Nasdaq futures have not yet broken down out of their triangle.

8/31 2:20

SPX needs to break under 1049 to get me short. The DJ 10-minute futures came down the 19 points under the M/A and I went short at 10,009 2%.

8/31 1:30

I count 3 down from Friday and 3 up today. I'll let the market tell me what to do. DJ futures light blue ascending line minus 19 points will get me back short.

SP futures almost touched their 30-minute M/A (1054.25 vs. 1054.70 M/A).

SP futures almost touched their 30-minute M/A (1054.25 vs. 1054.70 M/A).

8/31 12:20

Futures count 3 up complete. The final 5th looks like a diagonal so I doubt there is an extension.

.bmp)

8/31 11:40

A thrust to complete a 3rd wave up is in the cards. SP futures 30-minute M/A envelope is 1060.25. So any 30-minute close beyond 1060.50 (cash SPX 1061.75) tells me the rally is impulsive. It has to be a 30-minute close to count.

DJI 5-minute, 380-unit M/A is 10,083. I would like to go short again at that point.

DJ futures chart posted earlier today showed it's M/A at 10,042 with an envelope of 80 points, so 10,122 will confirm the SP 30-minute M/A envelope. The cash DJI equivalent is 10,134.

DJI 5-minute, 380-unit M/A is 10,083. I would like to go short again at that point.

DJ futures chart posted earlier today showed it's M/A at 10,042 with an envelope of 80 points, so 10,122 will confirm the SP 30-minute M/A envelope. The cash DJI equivalent is 10,134.

8/31 11:25

SP futures are forming a triangle. Selling the rest of SDS at 35.25

Looking at chart posted at yesterday's Daily, Minuette 4 could be forming a rectangle/triangle.

SP futures are indicating a higher top to this rally than 1055.

Looking at chart posted at yesterday's Daily, Minuette 4 could be forming a rectangle/triangle.

SP futures are indicating a higher top to this rally than 1055.

8/31 10:45

I have what appears to be corrective decline from Friday and impulsive rally today. Covered futures positions at a profit. DJ 10,003 and NQ 1769. Still have a lot of short ETFs.

Monday, August 30, 2010

8/30 Daily Commentary

Just got back from a trip to handle some family affairs. Met Jack C. for lunch and we had a good time.

I promised last week that I would re-calibrate the wave counts prior to the I1 cycle completion. So, according to my count we are currently we are in Minuette 5 of Minute 1 of Minor 3. DJI Min4 has no overlap of Min1 while SPX has trivial amount of overlap.

This count is adapted because the I1 bottom is due Thursday and the count delivers a bottom within the expected timeframe. It is at variance with EWI count which is that Minute 1 has completed and the current downwave is within Minuette 1 of Minute 3. This implies a longer period of slide to finish Minute 3 than I1 allows.

I'm currently short 1% NQ futures from 1787 and 2% DJ futures from 10179. 16% SDS and 8% QID.

I plan to go flat at Minute 1 bottom Thursday.

8/30 pre-open

Shorted DJ futures 2% 10,179 with stop 10,231. Entered at the 90-minute M/A.

The stop is the futures equivalent of the 5-minute, 380-unit M/A. The cash DJI M/A closed at 10,100. Add 1.35% to get 10,240 cash or 10,230 futures.

Saturday, August 28, 2010

8/28 Weekly Commentary

On the road so must make it brief. We have expanded flat in DJI, SPX, and XMI. 3-3-5. In the composite we have a zigzag 5-3-5, but it takes about the same form as the others. I count it complete. The DJI 5-minute, 380-unit M/A was crossed at 10,100 so it's envelope extends to 10,240. In order to maintain the Sub-Minuette 5 down scenario the DJI must stay below 10,180, the bottom of the 1st wave down last Friday. I was stopped out of 2% NQ futures at 1095.25 but am holding the short ETFs.

My new stop is DJI 10,181 for a quarter and 10,241 for a half of ETF positions.

My new stop is DJI 10,181 for a quarter and 10,241 for a half of ETF positions.

Friday, August 27, 2010

8/27 pre-open

Bought NQ futures 1% at 1784.50 as stated in yesterday's Daily. Stop 1795 on 2% futures.

Stop 1062 on half the ETFs.

I'll re-classify the wave count this weekend to show Minute1 of Minor3 in progress and expected to end at I1 bottom.

If my count is correct we are starting Sub-Minuette3 of Minuette5.

I'll be travelling today and will return Sunday.

Stop 1062 on half the ETFs.

I'll re-classify the wave count this weekend to show Minute1 of Minor3 in progress and expected to end at I1 bottom.

If my count is correct we are starting Sub-Minuette3 of Minuette5.

I'll be travelling today and will return Sunday.

Thursday, August 26, 2010

8/26 Addendum

Posting an overview of the count and the tactics leading up to the I1 bottom next week.

To me, looking down we are in Primary 3, Intermediate 1, Minor 3, Minute 3, Minuette 5, Sub-Minuette 3. EWI changed it's labelling in order to allow more running room for Minor 3. However, with I1 due to bottom next Wednesday/Thursday it is logical for either Minute 3 or Minute 5 to end at that time. I believe it will be Minute 5 that ends.

20100830 26.7774

20100831 25.81199

20100901 25.28408

20100902 25.06659

20100903 25.51281

20100906 26.69725

20100907 27.91625

20100908 29.58433

20100909 31.06375

20100910 32.49334

20100913 32.15619

20100914 31.46442

20100915 29.76997

20100916 27.14117

20100917 24.71507

20100920 22.96243

20100921 22.29074

20100922 21.8606

Notice that the I1 rising period lasts a week and spans greater than 5 (.5 in the adjusted I1 on the chart) and peaks greater than 32.25. This indicates that I will not hold short through it. If we have a conclusion of the first significant 5 down of Minor 3 next Thursday then a week is about the expected correction time (Minor 4) for a decline of 18 days.

Since the next degree above Minor is Intermediate and this degree is expected to last 6 months to 2 years I should be classifying the waves as Minuette instead of Minor. In order to avoid changing degrees in the midst of an I1 cycle I will wait until the I1 bottom to re-classify my wave count. The forecasting implications will remain the same, only the names will change. Actually, I shifted from the appropriate degree in response to EWI's shift over a week ago. EWI has shifted again to a count that I do not believe is appropriate for this stage in the I1.

Normal caveat: All of the above is theoretical and subject to the market.

To me, looking down we are in Primary 3, Intermediate 1, Minor 3, Minute 3, Minuette 5, Sub-Minuette 3. EWI changed it's labelling in order to allow more running room for Minor 3. However, with I1 due to bottom next Wednesday/Thursday it is logical for either Minute 3 or Minute 5 to end at that time. I believe it will be Minute 5 that ends.

My thesis is that we are re-testing the May/July lows in preparation for breaking them. We are coming down to moving-average support temporarily. One would expect the market to pause at these levels, perhaps building a Minute 4 rectangle, before plunging into a quick Minute 5 bottom. We have an excuse for a dump tomorrow in the form of "news". The daily technical composite is reaching into a sell signal, though it may not be there yet it is close. We have 4 trading sessions to finish Minute 3, Minute 4, and Minute 5 if there is to be a sizeable relief rally during the I1 rising stage starting later next week. This scenario is well within the context of a sustained, devastating decline through October.

First, the daily technical composite. It peaked at +22 just 2 days ago. Although +24 is an official sell threshold caution is in order as there have been several declines terminated at +22 over the past few years. By the time Minute 5 is done I expect it to be +24 and perhaps higher, depending on the depth of Minute 5.

The I1 bottom is pressing upon us.

While I1 bottoms Thursday I only expect a decline into mid-Thursday due to the fact that the I1 value Wednesday is so close.

20100826 29.52879

20100827 27.6858620100830 26.7774

20100831 25.81199

20100901 25.28408

20100902 25.06659

20100903 25.51281

20100906 26.69725

20100907 27.91625

20100908 29.58433

20100909 31.06375

20100910 32.49334

20100913 32.15619

20100914 31.46442

20100915 29.76997

20100916 27.14117

20100917 24.71507

20100920 22.96243

20100921 22.29074

20100922 21.8606

Notice that the I1 rising period lasts a week and spans greater than 5 (.5 in the adjusted I1 on the chart) and peaks greater than 32.25. This indicates that I will not hold short through it. If we have a conclusion of the first significant 5 down of Minor 3 next Thursday then a week is about the expected correction time (Minor 4) for a decline of 18 days.

Since the next degree above Minor is Intermediate and this degree is expected to last 6 months to 2 years I should be classifying the waves as Minuette instead of Minor. In order to avoid changing degrees in the midst of an I1 cycle I will wait until the I1 bottom to re-classify my wave count. The forecasting implications will remain the same, only the names will change. Actually, I shifted from the appropriate degree in response to EWI's shift over a week ago. EWI has shifted again to a count that I do not believe is appropriate for this stage in the I1.

Normal caveat: All of the above is theoretical and subject to the market.

8/26 Daily Commentary

Currently 9% SDS, 6% QID, 1% NQ futures. Will add 1% NQ futures at 1784.50 tonight, although it will probably not reach it.

According to my count we finished the 1st 5 wave down of Minuette5 of Minute3. The rally off of this was a abc back to the descending triangle. After hours futures are already testing today's low. In my count we are in Sub-Minuette3 of Minuette5. Washout tomorrow probably on GDP will mark a tradeable low, as Minute 3 ends.

Charles pointed out that the GDP revision will be a biggie tomorrow, with the market discounting 1.3% 2nd quarter. The economy is turning south a quarter ahead of when I estimated the stim would be coming off the rose. This will feed the Sub-Minuette 3rd wave in progress. EWI counts that yesterday's low completed the first Minuette of Minute 3. EWI changed the count to this to allow much more room for Minute 3. If this count were correct we would have had more punch. To me the rally overnight and early today looks just like a correction of Minuette 3 down and Minuette 5 is in progress to the downside.

8/26 3:15

Going back to the futures. Posted this Nasdaq futures chart before, but it clearly shows that the overnight high produced a 5 wave down that is not reflected in the cash charts. So, we should have finished this wave and into wave 2.

8/26 2:35

The 15-minute, 380-unit M/A was the floor for the descending triangle. It has been on a buy signal since yesterday. A switch to a sell signal will occur at SPX 1046.30.

8/26 2:00

If my count is right we are in Minuette 5 of Minute 3. It's time to look at places to cash in some chips. The DJI 340-day M/A comes in at 9,891. So if a 5 down winds up around that spot I'll cover most of my shorts.

8/26 11:10

Market has turned down now.

I still hold to a different wave count than EWI. In my mind the market is in Minuette4 of Minute3.

I still hold to a different wave count than EWI. In my mind the market is in Minuette4 of Minute3.

With this count 10,120 is the top of previous 4th wave. Fib 50% is at 10,124. So if the market is indeed turning down now it validates my count.

8/26 9:45

Cash indices double-topped with yesterday's highs preserving the count. We should not see SP futures above 1063 or SPX above 1066. This will stop out a quarter of my shorts.

Wednesday, August 25, 2010

8/25 Daily Commentary

The stock market completed Sub-Minuette 3 this morning. The housing number was bad but stocks took off so I figured that was all we would get out of Micro 5, the breakdown from the triangle formed from yesterday afternoon. Sold 4% SDS at 35.85 and covered the last 2% NQ futures at 1765. DJI advanced in simple abc.

Futures advanced in a different abc.

Even after reducing shorts I was still short 10% SDS and 8% QID. Added 4% SDS at 35.17 and 2% at 34.86. Put back NQ shorts for 2% at 1787. I don't expect the SP futures 30-minute M/A envelope to be exceeded at 1059, but I'll stop a quarter of my position at 1063. I'll stop the NQ futures using SP M/A. Why use a stop from a different market?...because tech relative strength today should give rise to relative weakness going forward, but I find SP M/As more reliable.

Looking forward to Minuette5 to finish off Minute3. EWI counts differently and considers today's low as the first Minuette of Minute 3.. I'll evaluate tonight and tomorrow.

I1 is still set for a bottom 9/2.

8/25 3:45

The envelope for the SP futures 30-minute M/A is 1059, cash 1062. This will be the stop for a quarter of my short position. Bought another 2% SDS 34.86

8/25 noon

SP futures hit 1037 to finish Sub-Minuette 3. Since we are now in a 4th wave let's count on a 38.1% retracement, 1053.5 futures, 1056.5 cash. It will take time to complete this wave, at least through today.

8/25 10:02

Stocks rallied on the new home sales report and terminated the down wave. Covered 2% NQ futures at 1765. Sold 4% SDS 35.85. Holding the rest of the short position until DJI 9900.

8/25 pre-open

Micro 4 is a triangle which looks complete.

This is part of Sub-Minuette 3 and Minuette 3. Sub-Minuette 1 was 35 points basis SP futures, from 1098. Minimum for Sub-Minuette 3 is 1035.

Tuesday, August 24, 2010

8/24 Daily Commentary

Stock futures came down overnight. I am still 2% short NQ futures and loaded up with short ETFs.

I was at the Acoma Pueblo today with my son and his wife, wishing them goodbye as they leave for Boston. I'm content leaving the market with wide stop because I don't want to over-trade this one.

I sold 1% NQ at 1786 pre-open on indications that the 3rd wave may have completed and I was going to be away from monitoring the markets. I would be relying on wide stops so I did a tiny bit of lightening up.

I was at the Acoma Pueblo today with my son and his wife, wishing them goodbye as they leave for Boston. I'm content leaving the market with wide stop because I don't want to over-trade this one.

I sold 1% NQ at 1786 pre-open on indications that the 3rd wave may have completed and I was going to be away from monitoring the markets. I would be relying on wide stops so I did a tiny bit of lightening up.

I still believe in this short and am holding positions. The above count is speculative because the cash market made a 3-wave up today. I am not altering my market bias and expect declines into 9/2. I'll keep it brief tonight and catch up on the pre-open tomorrow.

8/24 pre-open

Stock indices down overnight. This could be a short-term bottom. Covered 1% NQ futures 1786.25.

Still 2% ND short, 14% SDS, 8%QID.

Still 2% ND short, 14% SDS, 8%QID.

Monday, August 23, 2010

8/23 Daily Commentary

Stock market completed Minuette 2 this morning's rally. Sub-Minuette 1 ended and Sub-Minuette 2 was a long series of upward abc's off of a triangle. S2 is complete and S3 is in progress. After the close the futures declined to test Friday's lows

There are still 6-7 trading days to the next I1 low. The ideal low is 9/2, but 9/1 is just slightly higher. This will not be an important low because the subsequent I1 rise is only to 3.28, or slightly above the trading rules' hold short level.

In sum, it is not time to finesse this decline calling bottoms or adjusting positions. The technical picture is still neutral and I am giving I1 room to work. Stop above today's high.

In sum, it is not time to finesse this decline calling bottoms or adjusting positions. The technical picture is still neutral and I am giving I1 room to work. Stop above today's high.

8/23 1:00

DJI and SPX formed triangle as 2nd wave. So far no 5-waves up. If it breaks up then a 5-wave will be the form. Holding with no change in stop, DJI 25 points above the highs of the day.

8/23 11:00

At the close Friday I was awaiting an upside breakout of an ascending triangle to add to short positions. The move went a bit further than I thought it would but it stopped cold at the previous 4th. It looks like we have our first 5-wave down in progress. My stop is over this morning's high.

8/23 10:00

Sub-Minuette2 could be completed here, rising to the previous 4th wave extreme and tapping the 5-minute, 380-unit M/A simultaneously.

I earlier bought another 8% SDS at 33.75 and 33.46. I shorted another 1% NQ futures at 18.32.

8/23 9:45

DJI is coming up to it's 5-minute, 380-unit M/A. This M/A is my basic strategy. Trade in the direction of I1 when this M/A is reached. This will be another shorting point. Still holding 10% SDS and 6% QID as well as 3% NQ futures short.

8/23 pre-open

SP futures reached and exceeded the 30-minute M/A. The envelope is .5%, so any move beyond 1077.50 is my stop. Bought 4% SDS 33.75.

Sunday, August 22, 2010

Friday, August 20, 2010

8/20 Weekly Commentary

I have been thinking that DJI and SPX are in a 4th wave expanded flat. EWI counts Minuette1 done and Minuette2 in progress. Either way, one more high remains to complete it, perhaps Sunday evening or Monday morning. Targeting cash SPX 1076 to add to shorts. A better target is SP futures meeting their 30-minute M/A:

Cash indices show a 5 down more clearly than futures:

I am holding short and not trading.

8/20 3:52

Market needs upside breakout of the short-term triangle to finish the expanded flat. Probably after hours.

8/20 3:00

Expanded flat 3 of 5 up complete. I was thinking that the 5th wave will come up to the 30-minute M/A which will come down to 1076 at the close. DJI 10,250 will be enough to get me to add to shorts.

8/20 1:00

Expanded flat is playing out. Target SPX is about 1076.

SP futures I hope will come up to their 30-minute M/A (blue line):

8/20 noon

Cash DJI going below 10,140 will indicate that an expanded flat is out of the question and that S3 has extended. Staying short.

8/20 10:10

In the futures S4 is unfolding as an expanded flat, meaning a low below the S3 low followed by a 5 up.

This implies DJ futures c wave above 10,227. Target is still 10,277.

8/20 9:50

DJ futures re-test of 8/16 lows hit the .25% mark, down 25 points below the 8/16 low of 10,181. If this is not an extension of S3 down then prices should rally from here. Still 2% DJ short, 6% SDS, 6% QID.

8/20 pre-open

SP and DJ futures have broken their hourly M/A envelope.

Looks like the market is completing a small 5 down ending at a re-test of the 8/16 lows. Until DJ futures declines below 10,161 I'll expect a small bounce here, say to 10,277. If this is the bottom of Su-Minuette3 (that is, S3 does not extend) then this should take all day.

Looks like the market is completing a small 5 down ending at a re-test of the 8/16 lows. Until DJ futures declines below 10,161 I'll expect a small bounce here, say to 10,277. If this is the bottom of Su-Minuette3 (that is, S3 does not extend) then this should take all day.

Thursday, August 19, 2010

8/19 Daily Commentary

I am counting this uptick as Sub-Minuette4 of Minuette3. Now that the market has broken the 30-minute M/A the final hurdle is the 60-minute M/A -1.65%. Currently 1067. The Minuette1 low on the 16th was 1066.60 SP futures. So breaking this would also break the hourly M/A. Support at this level should be enough to keep the Sub-Minuette4 ball aloft at least overnight. If not then the market is in a big hurry to be lower.

I'm slowing down, not trying to guess the low, not trading but holding with a stop above 1106.

8/19 1:20

pima

In the chart you linked to the purported 5th wave up yesterday would have had to have been a failure, same with the DJI and XMI. I looked for 5th wave up yesterday but the only way the waves made sense was as a 3 wave.

In the chart you linked to the purported 5th wave up yesterday would have had to have been a failure, same with the DJI and XMI. I looked for 5th wave up yesterday but the only way the waves made sense was as a 3 wave.

8/19 11:00

I'll be posting hourly or every 2 hours now. The last thing I want to do is over-trade this move. I show a count of S3 possibly complete.

Wednesday, August 18, 2010

8/18 Daily Commentary

The count up from this morning's low was a 3 wave. A simple ABC to correct yesterday's decline.

I dumped 2% SDS and 2% QID when DJI crossed it's 61.8% retracement. That leaves me with 6% SDS, 6% QID, and 2% NQ futures.

The count shows even more clearly in the Nasdaq Comp but here is the SPX:

I dumped 2% SDS and 2% QID when DJI crossed it's 61.8% retracement. That leaves me with 6% SDS, 6% QID, and 2% NQ futures.

The count shows even more clearly in the Nasdaq Comp but here is the SPX:

I'll feel more comfortable once SP futures close .5% below their 30-minute M/A. They have declined to their 30-minute M/A right now. The launch for this morning's rally was SP futures at 30-minute M/A:

Subscribe to:

Posts (Atom)

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)

.bmp)