Recap: Came into today 2.5% long DDM at 47.91

Bought another 2.5% DDM 48.02 ARCA due to overnight confirmation 30-minute S&P futures.

Sold 2.5% DDM at 48.35 because the 5-wave from Thursday's low was completing.

Bought 5% SSO at 42.11 on return to SPX 15-minute 54-unit M/A

Bought another 2.5% SSO at 41.97 on return to critical support, DJI 5-minute, 380-unit M/A.

Currently 10% long stock market.

Here is current count:

Stock market completed the 1st and 2nd waves this morning . That gives Mr. Market plenty of time to complete waves 3 and 4 by close Thursday. Monday a pop higher will complete the 5 wave and provide a shorting opportunity. This is speculation at this point but it can serve until proven wrong.

Any decline below 10,720 will force me short.

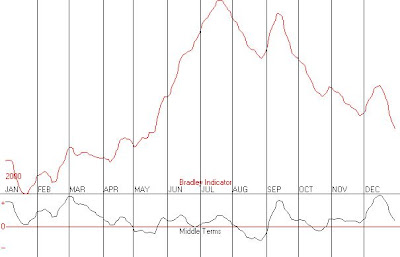

Got a comment that I1 turn dates are similar to Bradley Siderograph. I don't incorporate Bradley into I1, but it does include solar and lunar events (full/new moons, eclipses, even sunspots). However, I1 also includes atmospheric, oceanographic, and weather data.

I looked into Bradley many years ago but determined it's deficiencies were:

1) Turn date consistency was not good enough to rely upon.

2) Turn dates frequently inverted (that is, what was a top in Bradley turned out to be a bottom in prices) and the inversion was not detectable until well after the event because it's base reliability was not high enough to filter a bad turn from an inversion.

3) The values did not correspond to the degree of the move when it did work.

All of these objections are not valid with I1. Point 3 means that buy or signals based on levels of values are non-existent in Bradley but are the most important feature of I1. I1 is the only reason that I have been making money over the past several years, after 20 years of spotty results (I admit it, even the good years were not great). I pretty much abandoned almost all technical indicators and cycles. This simplified my work as well and left me more focused.

Here is Bradley followed by I1 for each year from 2000 through 2007. (It is time-consuming converting graphics for comparability and uploading data.):

2000:

2001:

2002:

2003:

2004:

2005:

2006:

2007:

No comments:

Post a Comment