The charts of the sentiment gauges for the dollar and bonds were posted in the Weekly Commentary. The implication of their simultaneous turn downward after the first week in April is that the linkage between markets due to excessive dollar creation will be broken at that time. In an environment without excessive currency creation the normal relationship between a stock market and a bond market is that rates will peak several months after the stock market peak. Looking around the world, interest rates are going up, not down. As a result of Fed policy (and QE2 in particular), the dollar is rapidly being replaced in international transactions. At the same time the disparity between short-term interest rates in the US and most other countries is becoming wider by the day. Emerging economies are being forced to raise rates to reduce the Fed-exported commodity inflation. Marginal economies in the EU generally have high debt loads and are rapidly being marginalized from willing creditors. Their interest rates are being thrust upon them and are rising apace. The remaining relatively healthy developed economies are breaking ranks with Ben and are engaged in de-facto if not outright rate-hiking out of fears of the long-term effects of prolonged ease. World monetary policy has been continuously easy for 2.5 years with QE making policy easier than appears on rate charts. This growing disparity in monetary policies between the U.S. and the rest of the world is bearish the dollar and is also damaging American prestige.

As the dollar is replaced in international transactions American fiscal and monetary policies will have less and less of an impact on other countries' actions. The number of dollar shorts has been steadily rising to the point that sentiment is almost 100% anti-dollar. The expected bounce from 3/25 through the first week of April in the dollar should be violent, but this rally will merely relieve technical and sentiment tension. The real rally in the dollar will occur in the global crunch time, from June through November, when U.S. stimulus wears off.

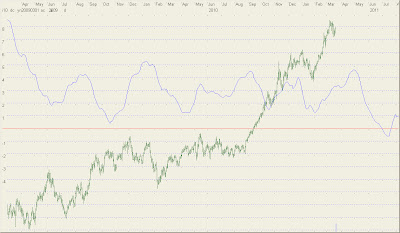

Precious metals, commodities, and the stock market all have appreciated due to QE2. Indeed, gold and silver are markets that are becoming convinced that they will never go down because the Fed will never cease creating excessive aggregate growth. It is becoming mantra. Will the Fed increase it's balance sheet beyond 3trillion? No, and as they reduce their assets the aggregates will slow down. I sold my gold at $1220 and silver at $22.50 at a triple because the natural forces were tipping into deflation, only to see QE2 be implemented, so this bubble is living on borrowed time. The following chart is the long view of the only aggregate that the Fed can directly control, the monetary base. This can be controlled via interest rate policy or QE. This is a smoothed view of a y/y change.

The following is an unsmoothed 6-month change:

As can be seen the latest data point (February) shows an acceleration beyond anything in the prior history of the Fed and that this is occuring in an environment with emerging worldwide inflation and a tentative recovery in U.S. economic series (production, business sentiment, employment, and others). QE2 will undoubtably force another ROC increase in the March number as the quantity of Fed assets approaches and exceeds 3 trillion. Helicopters are not employed in this environment and is the basis of my opinion that the markets that can only go up (gold and silver) will fall sharply. Two charts back up this view, first the PM1 sentiment gauge which calls for a peak at the end of April.

Next is a silver sentiment gauge that I use as part of the PM1. This issues signals with 100% track records since 1971, their inception. For sell signals any trough < -2.25.

Finally, the FOMC statement from the 15th clearly indicates that Ben is caving to the hawks, not only at the Fed but in Congress. A synopsis by the Wall Street Journal lays out the resistance to further easing surrounding Ben and the announcement signals their intent.

The economy is on a "firmer footing," while the labor market is "improving gradually" and household spending and business investment are expanding, the policy-making Federal Open Market Committee said in a statement following its one-day meeting. Cautionary words about the economy from previous statements were pared back. Meanwhile, energy-price increases have put upward pressure on inflation, the FOMC said. It expects this to be transitory but "will pay close attention," it said.

Fed Chairman Ben Bernanke and his colleagues are moving toward important decisions in the months ahead. The central bank's $600 billion Treasury bond purchase program is scheduled to be completed in June. The program will be an important subject of discussion at the next FOMC meeting in April. Officials will decide whether to let the program run out as planned, as many seem inclined to do. A debate about when and how to exit from their easy-money policies by raising interest rates seems to be taking shape for the second half of the year.

The comparison between the March statement and the prior statement regarding inflation is telling:

March statement:

Commodity prices have risen significantly since the summer, and concerns about global supplies of crude oil have contributed to a sharp run-up in oil prices in recent weeks. Nonetheless, longer-term inflation expectations have remained stable, and measures of underlying inflation have been subdued.

January statement:

Although commodity prices have risen, longer-term inflation expectations have remained stable, and measures of underlying inflation have been trending downward.

Subscribe to:

Post Comments (Atom)

Another great post. I agree, yet another blog I follow sees it in reverse.

ReplyDeletesmartmoneytracker.blogspot.com/2011/03/end-game.html

Not wishing to start a tit for tat but Id like to get your thoughts as this is a bright guy.

Great post, Steve. Much appreciated, all of it, but especially the commentary on the Fed's wording of this month's statement compared to January's.

ReplyDeleteWhat's interesting though is that it does appear that QE2 will not be followed by QE3 (at least right away), and yet the dollar continues crashing (even with intervention to push the YEN down) and PM's continue rising. You'd think the markets would be looking ahead to the end of QE2 and start pricing things accordingly, that is, dollar bottoming and heading up, and PM's topping and heading down.

Your PM! gauge has PM's going up till the end of next month! Have PM's ever peaked PRIOR to PM1 peaking?

Who said the fed would let the balance sheet contract after the end of QE2? They will most likely keep reinvesting the dollars from maturing assets, given the low duration of their holdings this equates to almost 750B a year. Details of how they would do this can be found here http://uleak.it/?063

ReplyDeleteThe balance sheet would not need to contract, the rate of change will still fall sharply. I know that gold bulls won't like this but gold and silver will crater when rate of change declines to historical norms. Besides, the Fed is coming under the microscope now because the pols have to hear from governments around the world how the Fed is making life hell for them. 2.5 years of off-the-chart ease is coming to an end.

ReplyDelete